National Pension System Equity Funds Deliver Strong 16 Percent Returns

The National Pension System’s equity funds have demonstrated exceptional performance, with leading fund managers delivering returns of up to 16% over a three-year period. These impressive returns showcase the potential of NPS as a retirement savings vehicle, with major players like UTI Pension Fund and Kotak Pension Fund leading the performance charts.

Table of Contents

Key Takeaways:

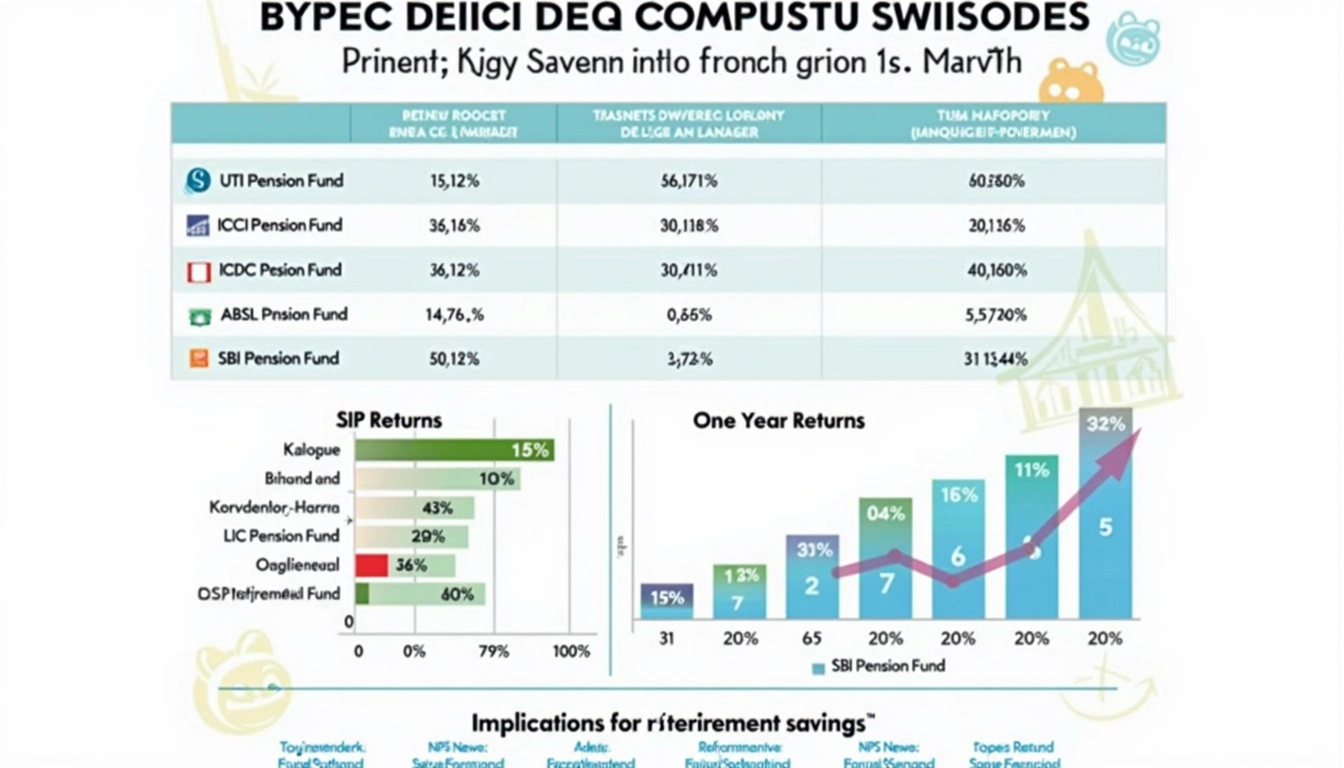

- Top performers in NPS equity funds achieved returns reaching 16% over three years

- UTI Pension Fund leads with 15.80% returns and Rs 3,257 crore AUM

- Monthly SIP investments show consistent growth across fund managers

- Short-term performance indicates robust returns up to 26.51% in one year

- Seven pension fund managers offer diverse investment options for retirement planning

Top-Performing NPS Fund Managers Analysis

The pension fund landscape shows remarkable variation in performance. Strategic investment approaches have led UTI Pension Fund to secure the top position with 15.80% returns, managing assets worth Rs 3,257 crore. Kotak Pension Fund follows closely with 15.58% returns and Rs 2,621 crore in assets under management.

Systematic Investment Plan Performance

The SIP returns paint an interesting picture of consistent growth. A monthly investment of Rs 1,000 over three years would have grown significantly across different fund managers. UTI Pension Fund leads this category as well, with returns of 12.87%, resulting in an accumulated amount of Rs 43,245.

Short-Term Growth Indicators

Recent performance metrics show promising results in the shorter term. Market dynamics have enabled DSP Pension Fund to achieve an impressive 26.51% return in the last year, while UTI Retirement Solutions secured 22.75%.

Investment Strategy and Future Outlook

The success of NPS equity funds stems from strategic asset allocation and professional management. Professional management strategies have proven crucial in delivering consistent returns. For those looking to automate their investment tracking and management, platforms like Latenode offer efficient solutions to monitor and optimize investment performance.

Making Informed Investment Choices

Selecting the right NPS fund manager requires careful consideration of both long-term and short-term performance metrics. The variation in returns across different mutual funds highlights the importance of thorough research before making investment decisions. Regular monitoring and periodic assessment of fund performance can help ensure optimal returns for retirement planning.